- Blog

- How to Remit Excess Cash to Bank from Post Office?

How to Remit Excess Cash to Bank from Post Office?

In this article,I’m going to expalin how to send excess cash to bank from a CSI migrated Post Office.

Why do we do excess cash remittance to bank?

Head Post Offices or LSG offices are attached to certain Banks for cash transactions. Each office has an office account in those Banks. When the cash collection exceeds the limit, we are not supposed to keep the excess cash in the post office. For instance,in a HO we can keep a maxmimum of 15 lakhs.

If a cash limit is exceeded,we should send cash to the office account in the bank. We can also retrieve the cash whenever we need it. This task is usually performed by either Treasurer-2 or the Head Postman.

How to perform cash remittance to bank?

Go to SAP (treasurer)

Enter T-code ZFFV50

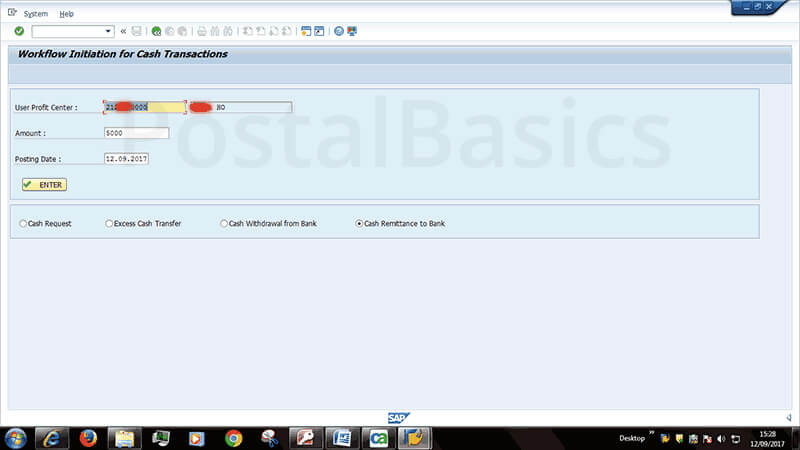

Below window will appear

USER PROFIT CENTER|Enter 10digit Profit Center number of your office. Amount|Eg.20000/-

Now, select CASH REMITTANCE TO BANK button.

Then click on ENTER

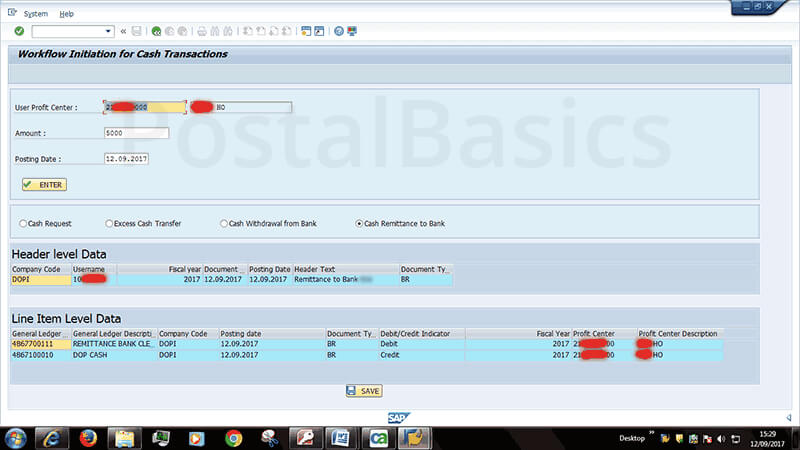

You should see this screen.

The system will take debit and credit GL codes automatically. Click on SAVE button.

Note down the Document number.

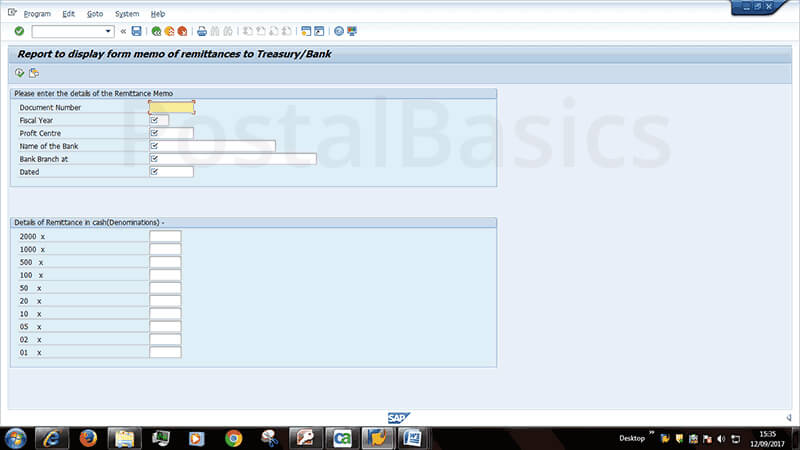

Now, enter T-code ZMEMO_REMIT for preparing ACG-11(MEMO OF REMITTANCE TO TREASURY/BANK).

The below window will show up.

Enter Document No. |xxxxxxxx Fiscal year |2017 Profit center | 10 Digit No. Name of the bank | xxx Date | 12.09.2017

Enter the denomination of currency notes used. Now click on Execute. ACG-11 will be generated. Take a print out of this document.

Once you have done this procedure, a message will go to the Supervisor inbox for approval. In order to approve, PM should follow this procedure: Go to Inbox >> Workflow >> Click on the message >> Release the amount.

This is how you can remit excess cash to bank. Please let me know if I have missed any step or you have a suggestion, in the comment section.

Thanks for reading!