- Blog

- Are you Getting Rich?

Are you Getting Rich?

Many of us salaried employees get a good paycheck but we never feel or become rich. For the readers of PostalBasics, we are defining the fundamental term “Rich”.

A person who has accumulated more wealth is considered rich.

Did you observe that I called “wealth” instead of “money”? That is the basic difference between rich and poor. Poor people think more money makes someone rich, which is not true. That is why some people never become rich.

There are three kinds of people in this world.

Poor people: They live on their day-to-day wages. They spend what they earn on their basic necessities.

Middle Class People: They buy liabilities and spend all their life repaying the liabilities (loans may be home loan, car loan or personal loan).

Rich People: They buy assets and generate enough cashflows to satisfy all their needs and wants.

There are a few things Rich people do that I’m going to mention here. But before that let’s define some financial terms that will help you go through the article.

| Assets | Liabilities |

|---|---|

| House given to rent | House you live in |

| Car given to rent | Car you own |

| Stocks & Shares | Cash |

| Prepaid SIM | Postpaid SIM |

| RD/TD/MIS/SSC account | SB account |

| Economic smartphone | Expensive Smartphone |

| Debit Card | Credit Card |

| Puts money in your pocket | Takes money from your pocket |

If you were to stop working today, how long can you survive? That will be defined by the assets you own. That will also define how rich you are.

If you think you can become rich by saving money, then you are on the wrong track. Go through the article to see why. Let’s see how you can change things and start moving towards getting rich.

Take Control

There are things in our life that give or take money from us. The first step is to identify them and control them however you can.

Bills.

Loans.

Shopping.

Other expenses.

Try to check what is your electricity bill, water bill, grocery bill, phone bill and other bills that you pay every month. These are essential and cannot be avoided. They can only be reduced to our necessity.

If you think you are getting higher electricity bill then see if you can install solar panels. The government offers around 40% subsidy on solar PV. There are ways to minimize bills if you put enough time to think about the issue.

Loans are good if they helped you get something expensive which you could not afford at a particular time. An Education Loan is a good loan. Once you get a job, you can repay it in time. The loan helped you get that job.

Clear off all the loans you have with Banks, friends, relatives or anyone. Postal Basics thinks that you should be debt free to move to the next step.

Some loans can help you save taxes but watch out for interest rates as well.

Acquire Assets

Many people think that owning a big house or a big car makes them rich. The house you are living in is not an asset! It takes money from your pocket in the form of water bill, electricity bill, cleaning and other expenses.

Consider that you are living in a simple house and have given a portion or a floor for rent. That part or floor puts money in your pocket every month. You don’t have to pay the bills, the tenant will do that. Now that house is an asset.

Acquiring assets may need some initial investment. It can be availed through bank loans and can be recovered pretty soon if you know how to use the asset to make money.

There are many types of assets. Important ones are,

Cash - Money in your hand or Bank.

Equities - Stocks/Shares.

Real Estate - Land or Building.

Virtual - Software, Website, App.

Gold etc.

There can be other assets but these are the major ones.

If you keep cash in your hand or stash it somewhere in the house, it is going to lose value. Imagine if your grandfather kept all his money(10,000 Rs) in the house somewhere safe. In his time 10,000 Rs is a huge amount. With that kind of money, your grandfather must be one of the richest guys in the town.

But if he did not buy any asset with that money, then after a few decades, it loses its value. Today, 10,000 Rs is not a big amount. Isn’t it?

Let’s imagine he puts the same amount in one of the assets I have mentioned above.

Consider your grandfather buys 166 Wipro shares in 2004 for Rs 60 each with 10,000 Rs he had. He will be getting more than 5,00,000 Rs today. It is far more than 5 lakhs but I have given a minimum estimate considering all the dividends they offered after 2014.

If he had bought some land in 2004, today its value is at least triple than what he had paid in 2004. Real Estate price has been increasing rapidly but it is not easy to liquidate(sell). So be cautious before you invest here.

If he had paid some developer to develop a website for 10,000 for his business in 2004, then his website must have earned him customers. The profit can’t be estimated but it usually is very high.

Postalbasics do not recommend owning gold even though it has been gaining value over time. We think that gold is good as an ornament but not so much in earning money for you.

If you really want to buy gold, then consider Sovereign Gold Bond offered by RBI. It is a form of digital gold where its value changes as per the gold rate. It also earns you 2.5% interest anually which is paid twice a year (once in 6 months).

If you had spent Rs 55,000 to buy a Royal Enfield motorcycle in 2001, you would now have an old, rugged bike. But if you had invested the same Rs 55,000 in shares (at Rs 17.50 per share) of Eicher Motors, the company that makes Enfield bikes, your investment will be worth Rs 5 crore as of 06 March, 2015!

Return on Investment

Investing in an asset is good but you have to calculate what is the return you will be getting back and in what time frame.

Imagine you build a house for 10 lakhs (I don’t think you can build one at this rate anywhere) and rent it for 6,000. If things go well then you can repay the loans(if you had taken any). If you do not get a tenant for a long time then it can be a burden on you.

A safer investment would have been keeping the same 10 lakhs in SCSS(Senior Citizen Savings Scheme). You have to put it under your parents or grandparents name and put yourself as the nominee(check eligibility). Currently, it offers 8.2% interest and pays out once in 3 months. This percentage may vary over time.

For an amount of 10 lakhs, 8.2% would be 6833 Rs monthly, which is more than the rent you were getting for the house. Also, this amount is liquid and can be taken out in emergencies.

Now, a clever investor would invest the 6,917 Rs that he gets every month in stocks, commodities, mutual funds and other risky investments. Someone who wants to go safely will put it on 5yr RD(Recurring Deposit) which offers quarterly compounding! Once you accumulate enough money this way, you can increase the SCSS to 30 lakhs(maximum) to get 20500 Rs every month(61500/3months).

RD is a boon to someone who wants to play safe. But, what I recommend is to invest it in equities(stocks/shares) or mutual funds which might offer more than 15% interest rate(risk involved). With the current growth rate of India, you should not hesitate put at least 20% of your earning in the stock market. That is how you should grow your money.

Get a demat account with Zerodha to invest in Mutual Funds

Another interesting mutual fund scheme is SWP(Systematic Withdrawal Scheme). It is the reverse of SIP(Systematic Investment Plan). Both are equally good. In SWP, you can put a lump sum amount in a fund you choose and opt for monthly, quarterly or yearly income from it.

You can set up this scheme so that you get a monthly income but your initial capital never exhausted. It serves as one of the retirement schemes.

If you somehow create a lump sum amount of 50 lakhs then you are safe to take a monthly income of 40,000 Rs without depleting your main capital.

PPF is a must for someone planning for long term investment(15yrs min). Since it is not exposed to equities, the stock market performance will not matter. The principal invested in the PPF qualifies for deduction under Section 80C. PPF offers 7.8% interest rate which is pretty good compared to other schemes.

| Year | Total Deposits | Total Interest | Balance |

|---|---|---|---|

| 1 | 1,20,000 | 4,688 | 1,24,688 |

| 2 | 2,40,000 | 18,468 | 2,58,468 |

| 3 | 3,60,000 | 42,002 | 4,02,002 |

| 4 | 4,80,000 | 76,001 | 5,56,001 |

| 5 | 6,00,000 | 1,21,229 | 7,21,229 |

| 6 | 7,20,000 | 1,78,505 | 8,98,505 |

| 7 | 8,40,000 | 2,48,705 | 10,88,705 |

| 8 | 9,60,000 | 3,32,774 | 12,92,774 |

| 9 | 10,80,000 | 4,31,723 | 15,11,723 |

| 10 | 12,00,000 | 5,46,635 | 17,46,635 |

Above table shows how much your money grows in 10 years if you invest 10,000 Rs every month. The final amount is 17.5 Lakhs for a total invested 12 lakhs! It will be 32 lakhs in the next 5 years. It will be 1 crore in 28 years. That is the power of compounding.

If you invest the same amount in Mutual Funds, the return would be more than 25 Lakhs after 10 years, 1 crore in 18 years considering 15% interest rate. It is always good to diversify your investments.

Do not put all your eggs in one basket.

Be Street Smart

I have seen people buying agricultaral land even though they are not farmers(they lease it). They buy it to avail loans(upto 3 Lakhs) for smaller interest rates(4%). They invest the money in some place else(not ethical) and earn more. This is one way to make a good capital from bank loan.

There are possibilities that the government waives off the loan(1 Lakh or below) like it happened in Uttar Pradesh last year. I will not recommend waiting for or availing these goodies which are meant for small farmers whose lives depend on the crops.

Reading books and being up to date with the current affairs will help you be smart in taking good decisions. It is good to take advice from experts on how to save taxes by these means. Money saved is money earned.

The secret of rich people is that they all have multiple sources of income and stock market is one of the most important sources. For getting rich you have to make the money work for you, not vice versa.

Finally, if you are interested in the Stock Market then get an account with Zerodha which offers zero brokerage charges on equities.

Zerodha has an easy interface to buy and sell shares in a few clicks. You can also save some tax under section 80C. With one Zerodha account you can learn about stock market, buy equities(shares), buy mutual funds, and more.

If you are a beginner to the stock market then I recommend investing in Mutual Funds. Just start with a simple index fund which just tracks the main Nifty index. Your money grows if the stock market does well. But you should have patience to wait.

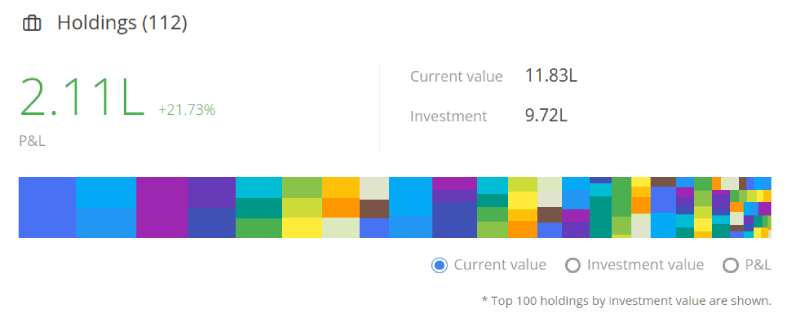

This is an image of how I have invested my money in the stock market. I have an unrealized profit of around 20% at the moment. It was at around 30% before COOVID-19. It usually keeps increasing as the shares I have bought performs well.

Currently, is there a bank that gives 15% interest? I don’t think so. One thing to keep in mind is to diversify your stocks. Buy shares of different companies from different sectors.

Remember, accumulate assets not money!

I hope the article has helped you in some way to manage your money. If you have liked the article then please spread the word and like our facebook page. If you have a better way of investing then please write to us.

Thanks for reading!