- Blog

- Cash conveyance or Office Expense in SAP Module of Post Office

Cash conveyance or Office Expense in SAP Module of Post Office

In this article I will be explaining how to do cash conveyance on SAP module. Cash conveyance is done to pay the office expenses such as Post Office electricity bill, if a vehicle is used for official use then the vehicle rent etc.,

Here is how it is done.

Enter Header Data

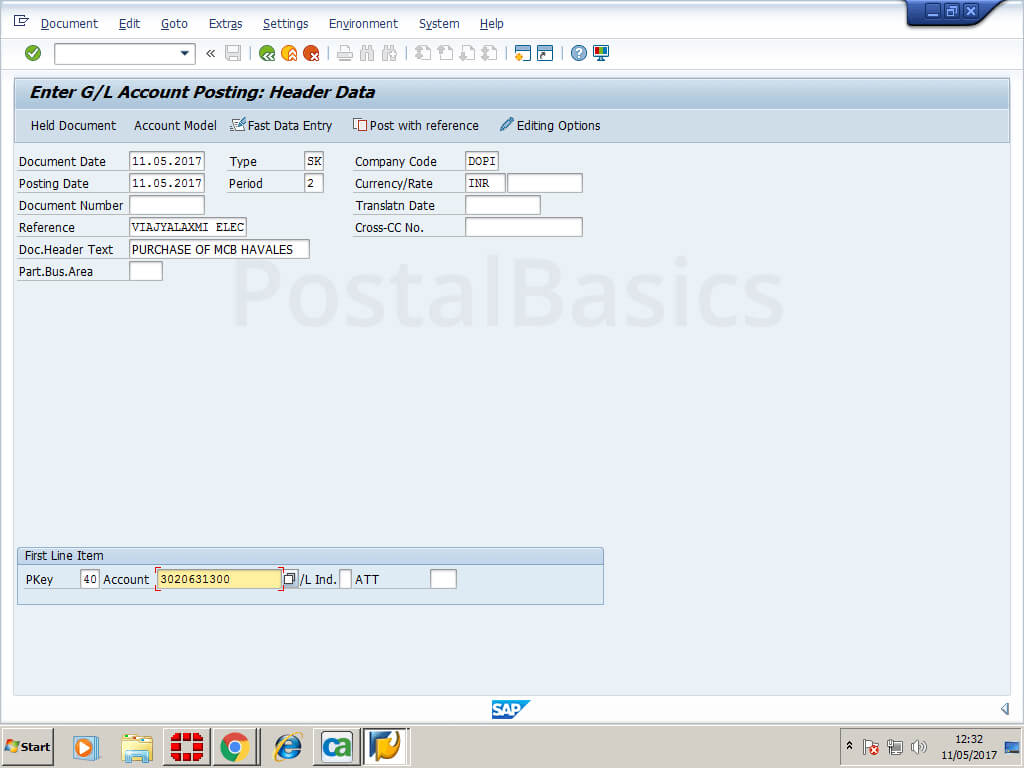

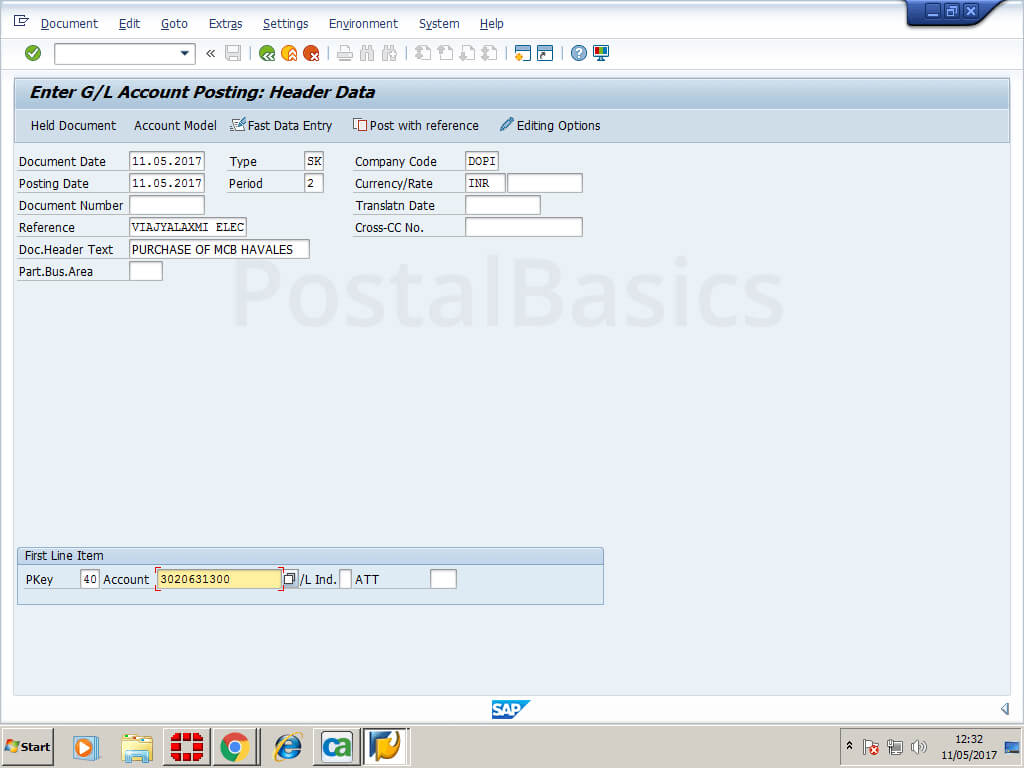

Open SAP module, enter T code F-02. This should open up the following screen.

Enter the following details.

| Doc date | current date | | Type | SK (only for cash payment) | | Company code | DOPI | | Posting date | current date | | Doc Header Text | write something reg. payment| | Period | 2 ( for May) |

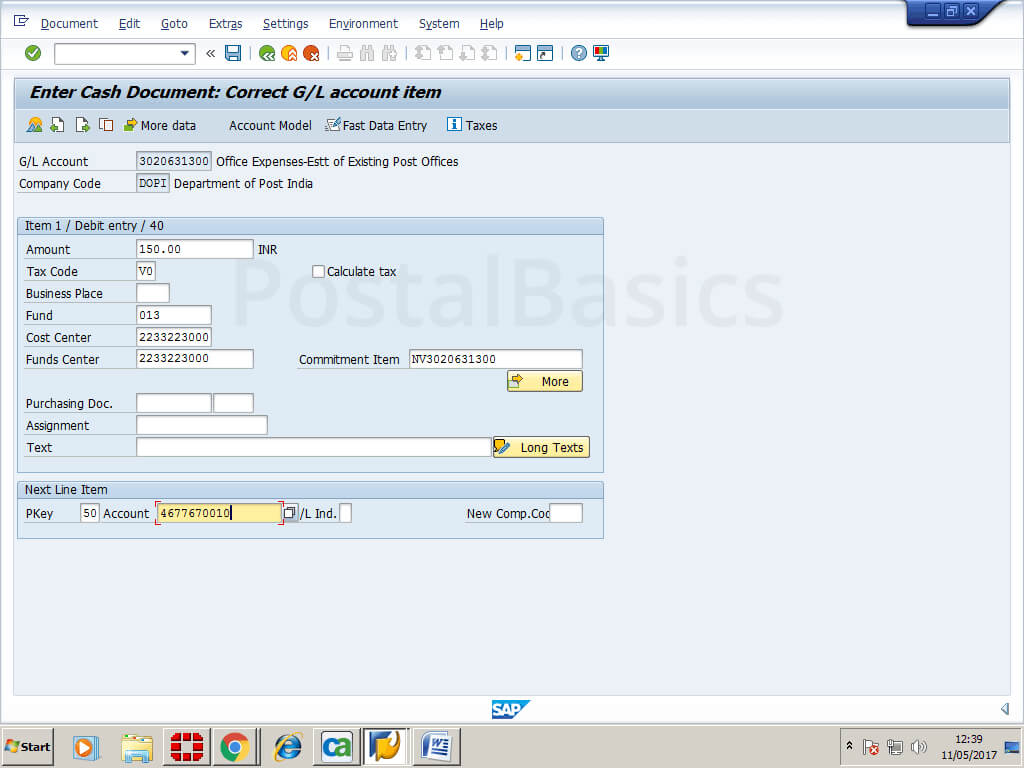

Enter PKey as 40, enter GL code for office expenses and hit Enter.

Specify Amount

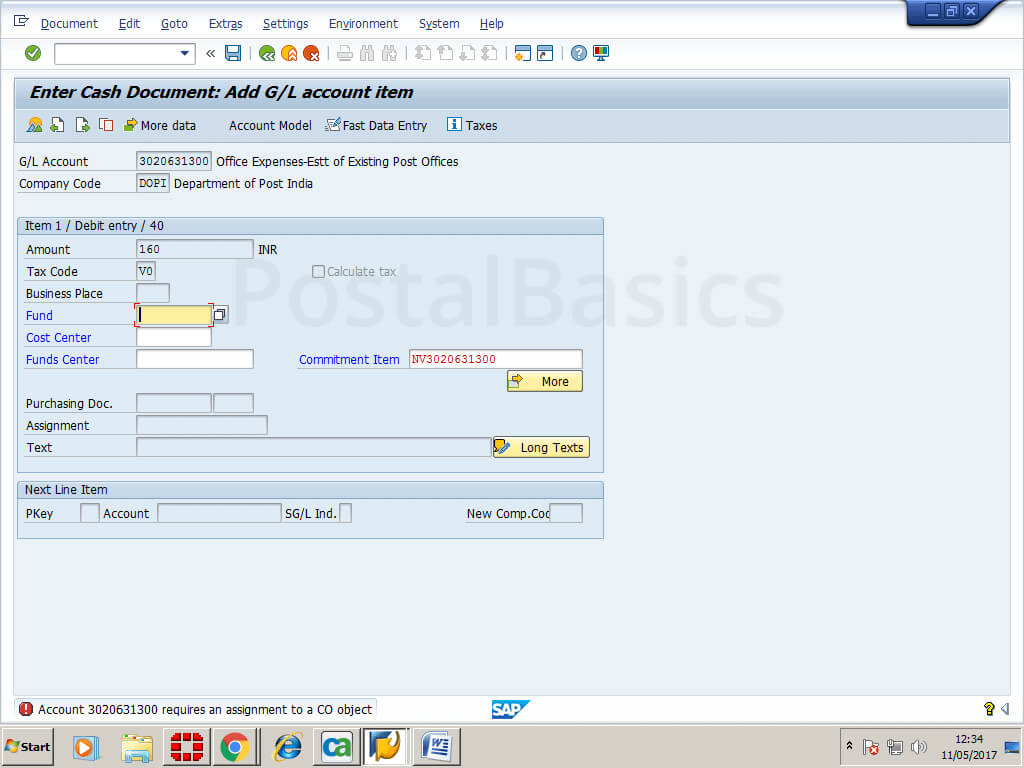

You will see GL code name for confirmation (Office expenses of existing Post Office). Fiil the following columns.

| Amount | 46484.70 (example) | | Tax code | V0(no tax) |

click on MORE

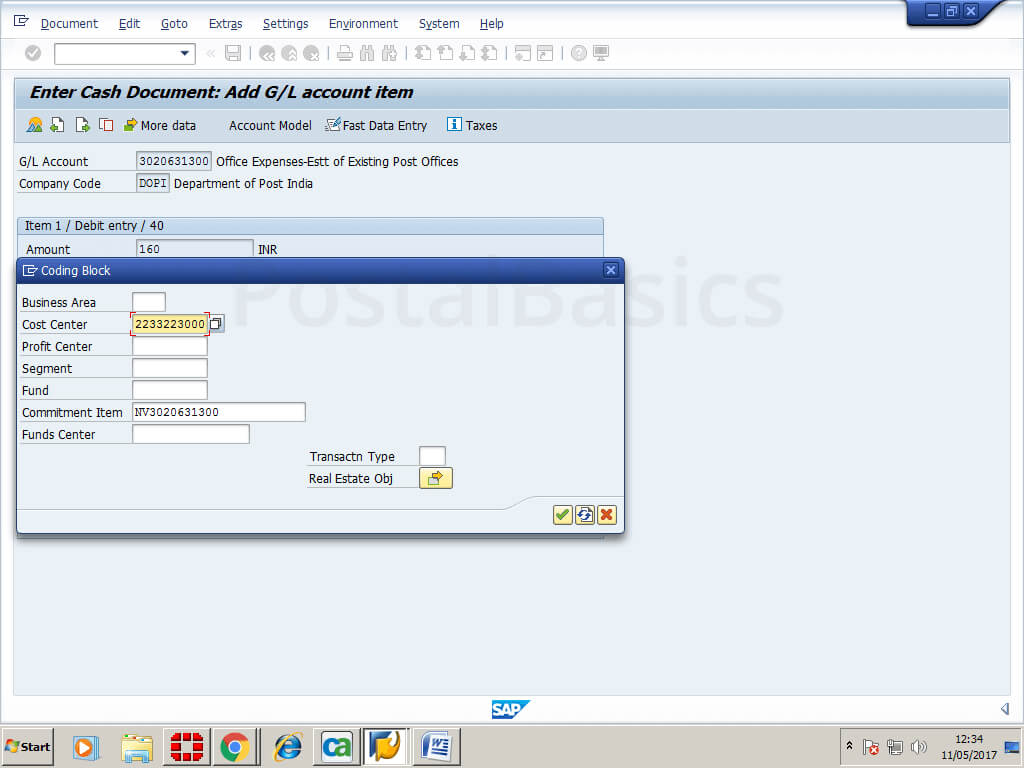

Cost Center Entry

Enter the following value.

| Cost center | 10 digit Profit Center ID |

Here respective Profit Center act as cost center in the first entry. Now, click on the right tick mark.

Credit Entry

| Pkey | 50(credit) | | Account | 10 digit DOP cash GL code |

Hit Enter.

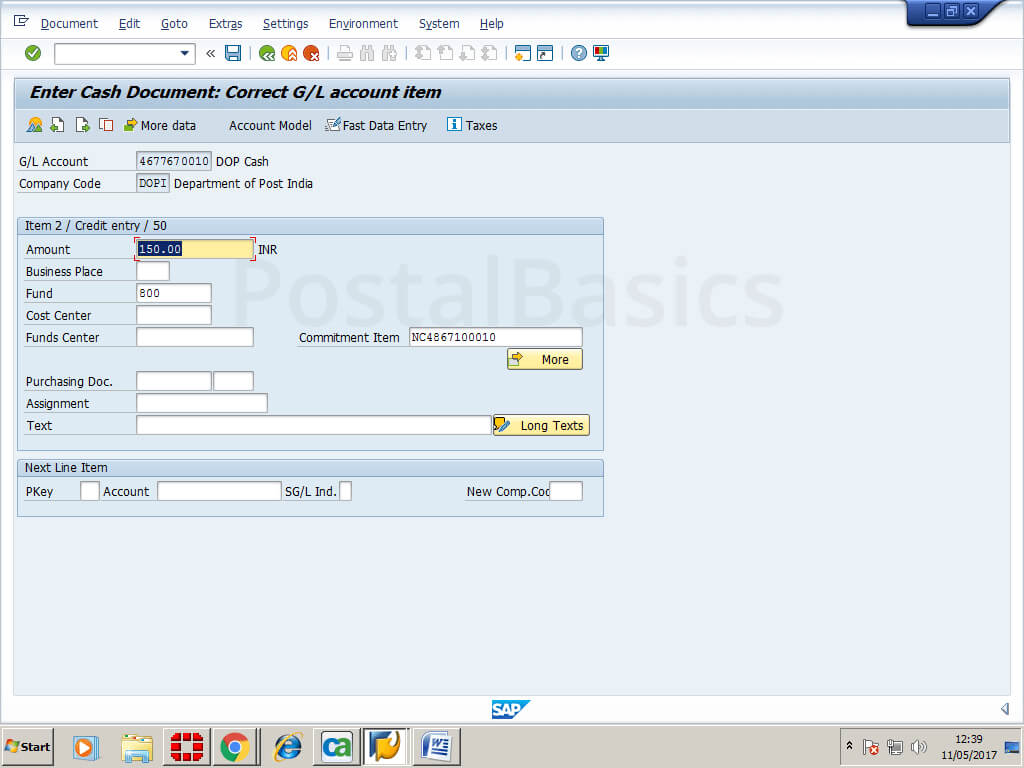

Enter the Amount

Enter the expense amount and click on More.

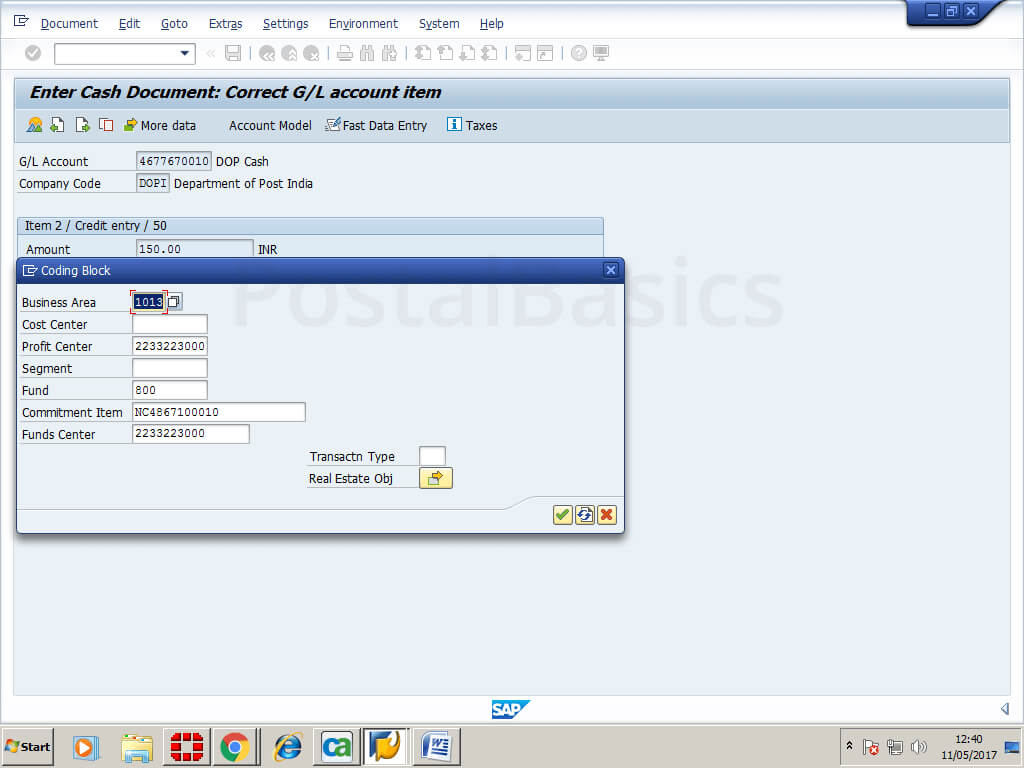

Profit Center Entry

| Profit center | 10 digit Profit Center ID |

Here respective Profit Center act as Profit center in the second entry. Click on right tick mark.

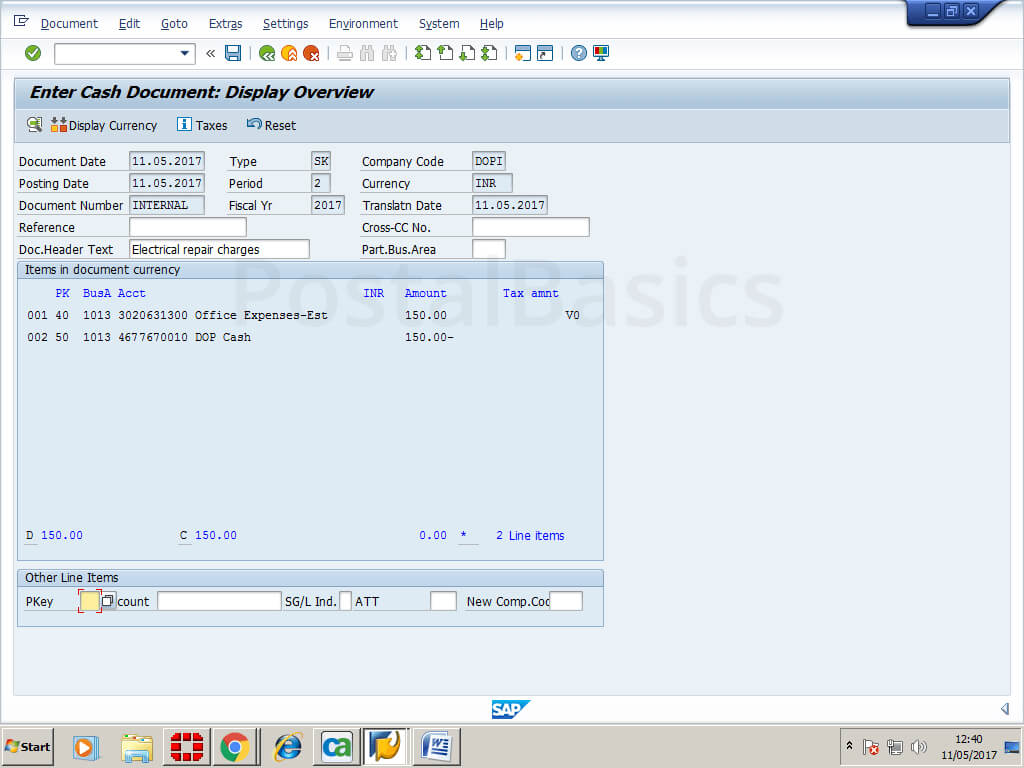

Simulation

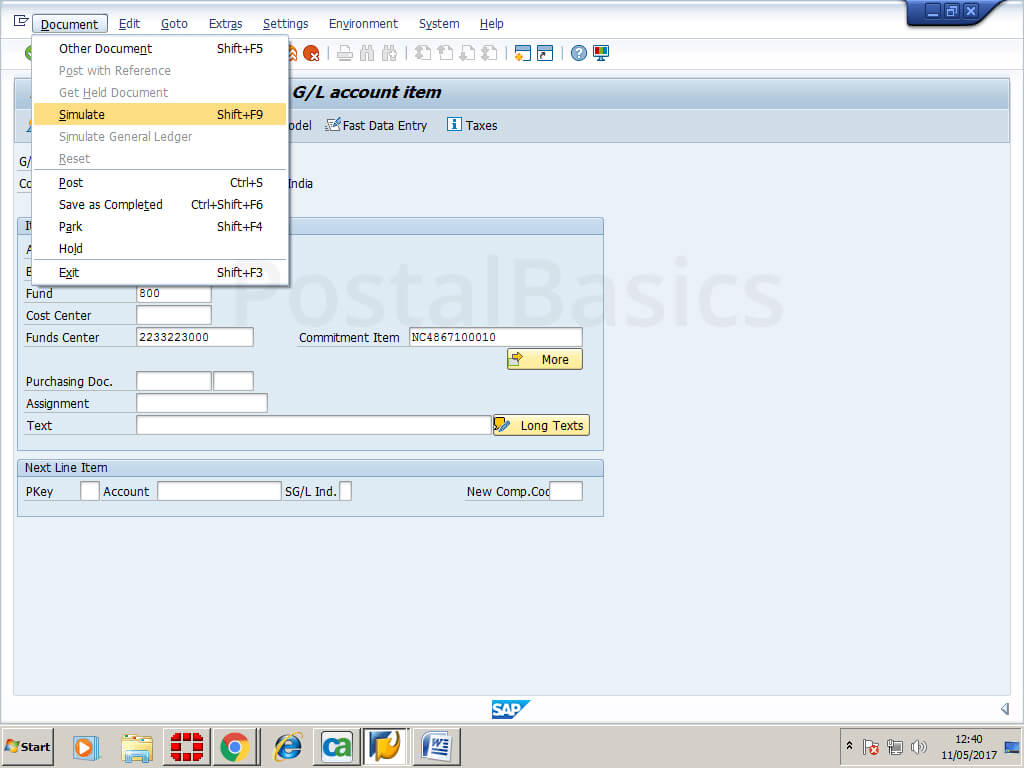

After the two entries are done, go to Document >> Simulate

In simulation you can clearly see the debit and credit entries. I’ll not talk about the debit and credit complexity but I would say that here amount added to the office expenses and it is subtracted from DOP cash.

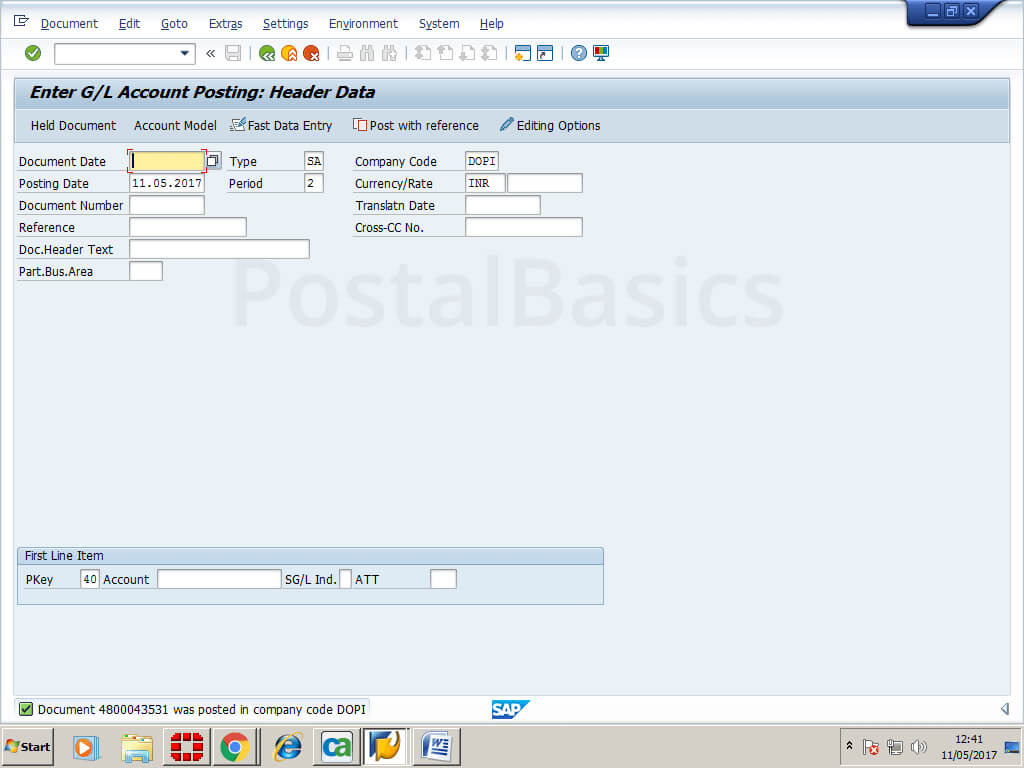

Document Generation

Once the simulation is done, click on Save. That should give us a message at the bottom saying Document xxxxxx was posted in company DOPI

Please note down the number as you may need this for reversal operation.

Ask any doubts, queries or suggestions in the comment section.

Thanks for Reading!