- Blog

- SWP is Amazing!

SWP is Amazing!

Systematic Withdrawal Plan

A Systematic Withdrawal Plan (SWP) is an investment strategy commonly used in mutual funds that allows investors invest a big amount in lumpsum and then withdraw a fixed amount of money at regular intervals, such as monthly or quarterly.

It can be really effectve in the long term. It can help you in case you are applying for loans such as home loan, car loan etc., that are of longer terms.

Let’s buy a car!

Imagine you have 12 Lakhs and I you want to buy a car you like which is of worth 10 Lakhs. Should you buy it with your money right away? Or apply for a loan? Or is there a better way? Let’s see

The direct way

You buy the car by paying 10 Lakhs. You lose no money on loan interest but you don’t gain anything as well. Respect!

The Loan way

Make a downpayment of 2 Lakhs. Then apply for a loan of 8 Lakhs. That’s the price of the car.

- Loan amount - 8 Lakhs

- Loan tenure - 5 years

- Interest rate - 9%

- Monthly EMI - 17,000

- Total you’ll pay - ₹17,000 × 60 = ₹10,20,000

- Extra money you paid - ₹10,20,000 - ₹8,00,000 = ₹2,20,000

So at the end you are paying an extra ₹2,20,000 as interest to the bank. You can pay it early to save some more money.

Now the SWP way

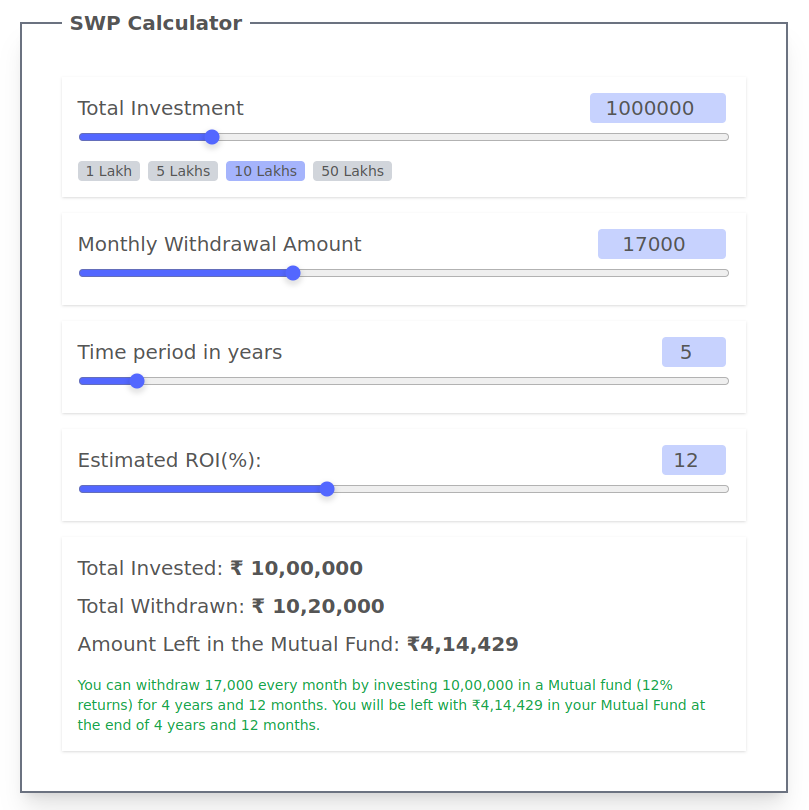

Make a downpayment of 2 Lakhs. Then keep the 10 Lakhs left with you in a Mutual Fund with a return of 12% which is pretty common among index funds. Then apply for a loan of 8 Lakhs.

Now again you will be paying the same EMI but not from your account but from SWP.

- Loan amount - 8 Lakhs

- Loan tenure - 5 years

- Interest rate - 9%

- Monthly EMI - 17,000

- Total you’ll pay - ₹17,000 × 60 = ₹10,20,000

- Extra money you paid - ₹10,20,000 - ₹8,00,000 = ₹2,20,000

But the twist is in the SWP earning for you for these 5 years.

You are left with ₹4,88,503 in your SWP!!

Eventhough you paid the same extra ₹2,20,000 to the bank, you have let your money grow with the market which beats the bank’s interest rate of 9%.

So you bought a car for ₹5,31,497 effectively.

Whenever you want to buy something expensive, try the SWP way. You might be surprised how much you save/earn.

Here is another example. Imagine you have 5 Lakhs in your account and you want ₹5000 every month as your expense.

If you do this from your savings bank account(4% returns), then you will loose 5 Lakhs in 10 years.

But if you keep the same 5 Lakhs in a mutual fund(12% returns), then you can take out ₹5000 every month for the next 38 years!!

But remember I have not considered the 20% of STCG or 12.5% LTCG (after 1 year) that is levied to the mutual fund gains!

Disclaimer:

Mutual funds are subjected to taxation based on the type of returns they generate, specifically capital gains and dividends. Profits gained from investments in mutual funds are categorized as ‘capital gains’, which are subject to tax depending on the holding period and the type of mutual fund.